Pay Statement Explainer

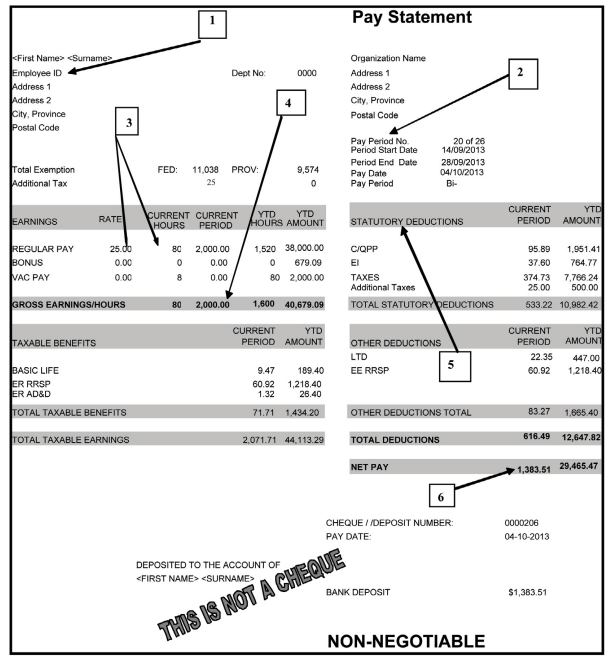

Below is a sample Pay Statement that a working Canadian may receive from their employer. It would mostly be sent to you electronically but in some cases an employer will present you with a physical copy.

A Pay Statement is a document listing the employee’s earnings, deductions and net pay. Employment/labour standards legislation in each province or territory details the information that must be reported on the pay statement.

The below example contains underlined words, click on one to see that term explained.

Pay Statement

Period Start Date October 7, 2024

Period End Date October 20, 2024

Pay Date October 25, 2024

EARNINGS RATE HRS AMOUNT YTD HRS YTD AMOUNT

Regular Pay 25.00 80 2000.00 1,520 38,000.00

Bonus 0.00 0 0.00 0 679.09

Vac Pay 0.00 8 0.00 80 2000.00

GROSS EARNINGS/HRS 80 2000.00 1,600 40,679.09

TAXABLE BENEFITS CURRENT AMOUNT YTD AMOUNT

Basic Life 9.47 189.40

ER RRSP 60.92 1,218.40

ER AD&D 1.32 26.40

TOTAL TAXABLE BENEFITS 71.71 1,434.20

TOTAL TAXABLE EARNINGS 2,071.71 44,113.29

First Name, Surname

STATUTORY DEDUCTIONS CURRENT PERIOD YTD AMOUNT

C/QPP 95.89 1951.41

EI 37.60 764.77

TAXES 374.73 7766.24

Additional Taxes 25.00 500.00

TOTAL STATUTORY DEDUCTIONS 533.22 10,982.42

OTHER DEDUCTIONS CURRENT PERIOD YTD AMOUNT

LTD 22.35 447.00

EE RRSP 60.92 1,218.40

Other Deductions Total 83.27 1,665.40

TOTAL DEDUCTIONS 616.49 12,647.82

NET PAY 1,383.51 29,465.47

Cheque/Deposit Number 00002806

Pay Date October 25, 2024

Bank Deposit $1,383.51

1. Employee Details

- Includes your name, residence address, and possible employee ID assigned by your organization

2. Pay Period No.

- The number of times an organization has paid employees in a calendar year. In this example the employer pays every two weeks, so there are 26 pay periods in a year (52 weeks divided by 2).

3. Rate

- The amount the employee is being paid per hour. In this case, the rate is $25.00 per hour.

4. Gross Earnings/Hours

- The total of the amount earned from the employees salary, bonus, and vacation pay or the total number of hours worked.

5. Statutory Deductions

- Deductions that must be taken from an employee’s pay as required by federal or provincial laws. These deductions take priority over all other payroll deductions.

6. Net Pay

- The total amount an employee takes home after deductions. To calculate this you would take the total Gross Earnings and subtract the Total Deductions. On this Statement that would be $2,071.71 – $616.49 equalling a Net Pay of $1,383.51.

Unsure about the other terms on the Pay Statement? View the full list below.

Employee Details

- Includes your name, residence address, and possible employee ID assigned by your organization

Total Exemption

- The amount of earnings you can earn annually and not have to pay Federal or Provincial Income Tax

Rate

- The amount the employee is being paid per hour. In this case, the rate is $25.00 per hour.

Amount

- The total amount of money earned for this pay period. It is calculated by multiplying the hourly wage by the number of hours worked. In this case $25.00 x 80 hours equals $2,000.00.

Year to date hours

- The total number of hours worked in a calendar year as of the current paycheque. In this case the employee has worked 1,520 hours from January 1 to the present.

Year to date amount

- The total amount of money earned in a calendar year as of the current paycheque. In this case the employee has earned $38,000 from January 1 to the present.

Regular Pay

- The standard amount earned by working a set number of hours per week. This would be the amount of money agreed to per hour in the employee contract and not include items like overtime.

Bonus

- Extra pay given to employees, usually based on individual or organization performance. In this example we can see that no bonus was given during this pay but earlier in the year the employee received a bonus of $679.09 (indicated in the YTD Amount).

Vacation Pay

- Amount paid pursuant to employment/labour standards legislation, an employment contract or a collective agreement that is earned/accrued during the vacation entitlement year. Vacation pay is calculated as a percentage or fraction of vacationable earnings.

Gross Earnings/Hours

- The total of the amount earned from the employees salary, bonus, and vacation pay or the total number of hours worked.

Taxable Benefits

- Benefit paid in whole or part by the employer and considered taxable under the federal Income Tax Act or Quebec Taxation Act. This can include items such as parking, life insurance, RRSP contributions by the employer, and accidental death and dismemberment coverage.

Total Taxable Earnings

- The combined amount of regular pay, bonus, vacation pay AND taxable benefits. This amount is then used to determine the amount an employee is taxed in the next column of the Pay Statement.

Deposited to the account of

- Who will receive the money – also known as the employee.

Employer Details

- The details about the organization you work for, including the head office address

Pay Period No.

- The number of times an organization has paid employees in a calendar year. In this example the employer pays every two weeks, so there are 26 pay periods in a year (52 weeks divided by 2).

Pay Period

- How often you are paid. In this example, the employee is paid every two weeks. Other common examples are bi-monthly (twice a month) and weekly.

Statutory Deductions

- Deductions that must be taken from an employee’s pay as required by federal or provincial laws. These deductions take priority over all other payroll deductions.

C/QPP

- Can mean one of two things, if you work outside of Quebec it is the:

- Canada Pension Plan (CPP) – provides pensions and benefits when contributors retire, become disabled, or die. The standard age of receiving CPP is 65, however you can start as early as 60 or as late as 70.

- if you work inside of Quebec it is the:

- Quebec Pension Plan (QPP) – a compulsory public insurance plan for workers in Quebec aged 18 and over whose annual employment income is greater than $3,500. Its purpose is to provide persons who work or have worked in Quebec and their families with basic financial protection in the event of retirement, death or disability. The standard age to start receiving QPP is 65.

Employment Insurance (EI)

- Social insurance program administered by Service Canada that provides financial assistance to employees who are temporarily unemployed. The plan also provides benefits for employees on sick, maternity, parental or compassionate leave for employees outside Quebec; Revenu Québec has its own program that offers maternity, paternity, and parental benefits. Employers and employees contribute to the plan.

Income Tax

- Amount which must be deducted from an employee’s earnings before payment is made to the employee. The deduction is mandatory by federal and provincial law, and the rates are changed annually (sometimes semi-annually) by legislation.

Additional Taxes

-

Extra tax you may want to deduct in addition to the regular taxes calculated on your paycheque. You can deduct the additional Federal tax or Quebec provincial tax amounts by indicating this information on the TD1 or TP-1015.3v which then needs to be sent to your employer.

Total Statutory Deductions

- The combined amount of deductions that go to government taxes from your earnings. This includes provincial and federal taxes.

Other Deductions

- Amounts that can be subtracted from your earnings that are not government taxes. This includes long term disability and employee contributions to an RRSP.

Total Deductions

- The combined amount of government and non-government deductions that will be subtracted from your earnings. In this example the total is $616.49

Net Pay

- The total amount an employee takes home after deductions. To calculate this you would take the total Gross Earnings and subtract the Total Deductions. On this Statement that would be $2,071.71 – $616.49 equalling a Net Pay of $1,383.51.

Cheque/Deposit Number

- An internal reference number to prove that money was sent to your account.

Pay Date

- The day you receive your earnings.

Bank Deposit

- The amount of money you will be receiving in your bank account on pay day.